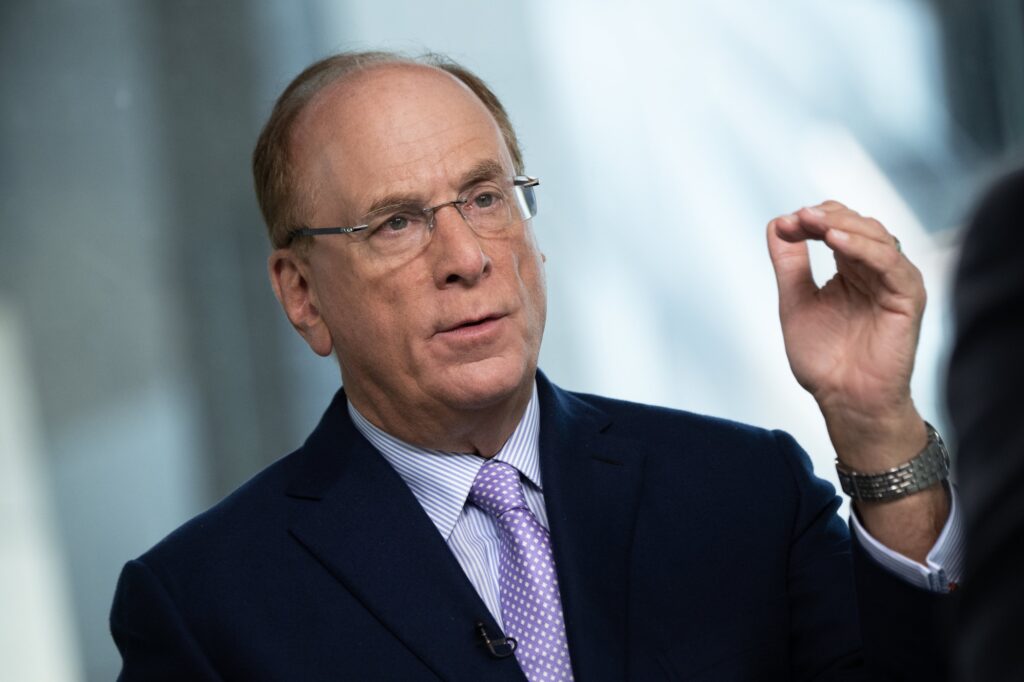

In a rapidly ageing world, the specter of a retirement crisis looms large, as highlighted by Larry Fink, the CEO of BlackRock. As life expectancies rise and birth rates decline, societies face unprecedented challenges in sustaining retirement systems. This article delves into the nuances of this impending crisis, providing insights and solutions to navigate through these turbulent times.

The Silver Tsunami: Ageing Population Dynamics

The world is witnessing an unprecedented demographic shift, characterized by a significant increase in the proportion of elderly individuals. This phenomenon, often referred to as the “silver tsunami,” stems from declining fertility rates and advancements in healthcare, leading to longer life expectancies.

Impact on Retirement Systems

Strain on Pension Funds

With a larger retired population and fewer individuals contributing to pension funds, traditional retirement systems face immense strain. This imbalance threatens the sustainability of pension schemes, jeopardizing the financial security of retirees.

Healthcare Challenges

Ageing populations also place considerable strain on healthcare systems, leading to increased healthcare expenditures. As individuals age, they require more extensive medical care, further exacerbating the financial burden on governments and healthcare providers.

Addressing the Retirement Crisis

Rethinking Retirement Age

Flexible Retirement Policies

To address the retirement crisis, policymakers must consider implementing flexible retirement policies. By allowing individuals to work beyond traditional retirement ages, societies can alleviate the strain on pension systems while harnessing the skills and experience of older workers.

Encouraging Savings and Investments

Financial Literacy Programs

Promoting financial literacy programs can empower individuals to make informed decisions about saving and investing for retirement. By educating the populace on financial planning and investment strategies, societies can foster a culture of saving for the future.

Embracing Technological Solutions

Innovation in Retirement Planning

Technological advancements present opportunities to revolutionize retirement planning. From robo-advisors to digital pension platforms, innovative solutions can streamline retirement savings and investment management, making them more accessible and efficient.

Larry Fink Warns Retirement Crisis Looms for Ageing World Population

Acknowledging the Warning Signs

Larry Fink’s warning underscores the urgency of addressing the retirement crisis. As the head of one of the world’s largest asset management firms, Fink’s insights carry significant weight, serving as a clarion call for action.

Proactive Measures

Fink advocates for proactive measures to mitigate the impending crisis, emphasizing the importance of long-term planning and strategic investments. By heeding his advice, individuals, governments, and businesses can navigate the challenges posed by an ageing population.

FAQs (Frequently Asked Questions)

- What factors contribute to the retirement crisis? The retirement crisis is fueled by declining birth rates, longer life expectancies, and inadequate retirement savings.

- How can individuals prepare for retirement in the face of this crisis? Individuals can prepare for retirement by saving diligently, investing wisely, and exploring alternative sources of income, such as part-time work or entrepreneurship.

- What role do governments play in addressing the retirement crisis? Governments play a crucial role in addressing the retirement crisis by implementing policies that promote savings, extend retirement ages, and strengthen social safety nets.

- How can technology help alleviate the retirement crisis? Technology can facilitate retirement planning by offering digital investment platforms, retirement calculators, and educational resources to empower individuals in managing their finances effectively.

- Are there any global initiatives aimed at addressing the retirement crisis? Several global initiatives, such as the World Economic Forum’s Retirement Readiness Initiative, focus on raising awareness and developing solutions to enhance retirement security worldwide.

- What are the consequences of inaction in addressing the retirement crisis? Failure to address the retirement crisis could lead to widespread financial insecurity among retirees, increased strain on social welfare systems, and intergenerational economic disparities.